You can obtain various types of insurance without a license, such as health insurance, renters insurance, or travel insurance. These policies typically don’t require you to hold a specific license, as they are purchased directly from providers or online platforms. Be that as it may, you may need to provide identification or proof of residency. Keep in mind that certain high-risk or specialized insurance products might have additional restrictions or guidelines. Always review the terms carefully & consider consulting with an insurance agent for personalized options tailored to your needs.

what insurance can i get without a license. Looking for insurance options without a license? Discover what you can get & how to protect yourself easily, even without a driving permit!

Understanding Insurance Without a License

Many individuals wonder about options available regarding insurance when they lack a valid driver’s license. Personal experiences may vary, but navigating this sector can pose challenges. I faced this situation firsthand while exploring possible insurance types. After conducting extensive research, I discovered various products aimed at those without licenses.

Types of Insurance Available Without a License

Health Insurance

Obtaining health coverage typically does not require a license. Various plans provide excellent benefits, covering consultations, treatments, & medications. It remains essential for individuals seeking coverage due to medical costs or unforeseen health events.

Marketplace plans under the Affordable Care Act serve as ideal options. Individuals can explore different tiers based on their needs & financial situations. No need to present a license when shopping for plans.

And another thing, Medicaid offers support for low-income individuals. Eligibility criteria focus on income level rather than a valid driver’s license. Many benefit from this program nationwide, ensuring access to essential healthcare services.

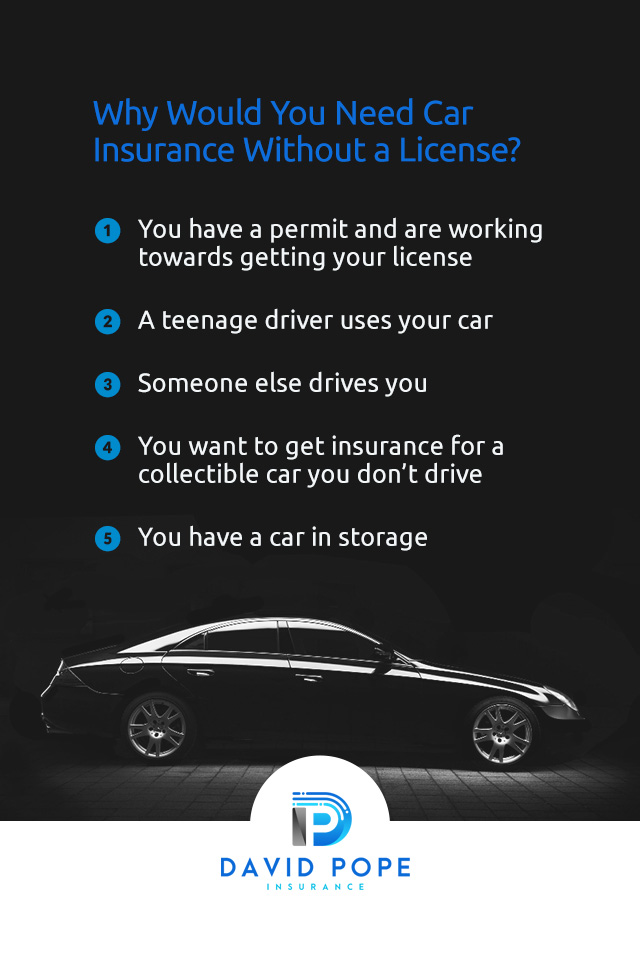

Car Insurance Options

Car insurance generally requires a license for drivers. Be that as it may, situations arise where someone may need coverage despite not possessing a valid license. In such scenarios, options exist for non-licensed drivers.

Non-owner car insurance represents one popular choice. This plan provides liability coverage for individuals who frequently borrow cars or rent vehicles. It protects them against potential damages while driving others’ automobiles.

Specialty insurers may cater specifically to non-licensed individuals seeking car insurance. These companies often focus on unique situations, offering policies tailored to individual needs without licensing requirements.

Specialized Insurance for Specific Circumstances

Travel Insurance

Traveling abroad or even within one’s country poses risks. Travel insurance provides a safety net against unforeseen events like trip cancellations, lost luggage, or medical emergencies while away from home. Fortunately, acquiring travel insurance does not hinge on possessing a license.

Purchasing a plan involves filling out an application online, wherein you can select coverage levels without any licensing requirement. Many companies specialize in protecting travelers, ensuring safety even without a license.

Reviewing options thoroughly remains crucial. Best practices include comparing policies, assessing coverage limitations, & checking company reputations all contributing factors toward informed travel decisions.

Home Insurance

Homeowners without a valid license can still obtain homeowners insurance. Coverage typically protects structures & belongings from various risks like fire, theft, & natural disasters. Insurance companies assess individual risks based on property conditions rather than driving credentials.

When applying for quotes, individuals need not provide documentation related to a license. Instead, a thorough evaluation of property details such as location, size, & security features takes precedence.

Renters can also find insurance options to protect personal belongings within a rental unit. Policies example coverage for theft, damage, & liability risks that may arise while renting. Focusing on coverage specifics underlines its importance for renters, especially in high-risk areas.

Pet Insurance for Animal Lovers

Why Pet Insurance Matters

Pet owners value their furry companions’ health & well-being. Securing an insurance policy for pets provides peace of mind against unexpected veterinary expenses. Good news: obtaining pet insurance doesn’t require a license.

Various options exist, covering services like annual check-ups, vaccinations, & emergency treatments. Pet-specific plans undergo application processes devoid of driving credentials; thus, individuals confidently enroll, ensuring pets receive adequate care during emergencies.

Comparing plans remains essential; different providers offer unique coverage levels & pricing structures. Some even provide added perks such as wellness coverage, enabling pet owners access preventive care while minimizing expenses.

Liability Insurance for Non-licensed Individuals

Liability insurance serves as a vital financial shield for individuals, protecting against claims arising from injuries or damages caused during an incident. Securing this type of insurance often doesn’t necessitate showcasing a license.

Individuals engaging in freelance work or casual business ventures often benefit from general liability policies. These plans cover legal expenses & settlements connected with claims against individuals operating without a formal business license.

Those working on an informal basis, like babysitters or dog walkers, consider specific liability coverage tailored for non-licensed activities. These policies afford financial protection while engaging in activities for which no formal documentation exists.

Understanding State Regulations

Insurance Laws Varying by State

Insurance laws fluctuate across states, making it crucial for individuals without a license to familiarize themselves with specific regulations applicable in their regions. States establish distinct guidelines about insurance products available for non-licensed individuals.

Researching state laws assists individuals in navigating potential avenues for obtaining various types of coverage. Coverage categories might differ significantly; it remains essential thus for potential policyholders to take proactive measures.

In-depth knowledge ensures compliance with local regulations while exploring insurance options. Therefore, individuals should consult resources like state insurance departments for accurate information regarding available policies.

Resources for Non-licensed Individuals Seeking Insurance

Various resources exist to aid non-licensed individuals seeking insurance. Researching available options often poses challenges, especially without access to traditional platforms. Be that as it may, numerous organizations & websites specialize in providing support for individuals without driving licenses.

Online forums & community groups frequently share insights & experiences related to different insurance types. Engaging with others can reveal useful tips that enhance overall understanding of navigating coverage options efficiently.

And another thing, state-specific websites & social media groups create spaces where individuals can ask questions, receive advice from peers, & discover potential coverage opportunities tailored specifically for their unique situations.

Insurance Options for Business Owners without a License

Business Liability Insurance

Entrepreneurs operating businesses without a traditional license can seek business liability insurance. This coverage provides essential protection against lawsuits, accidents, or injuries occurring within an established business setting.

Many insurers do not require a formal business license for applying; interest in safeguarding businesses holds primary importance. Potential policyholders should examine product offerings from various insurers to ensure comprehensive coverage.

Focusing on specific policies that align with business practices, such as general liability or professional liability, enhances overall protection for aspiring entrepreneurs. Staying informed about requirements simplifies application processes.

Professional Liability Insurance for Freelancers

Freelancers often face distinct challenges when securing coverage. Professional liability insurance protects individuals in service-related professions from potential lawsuits connected with negligence claims. Good news: acquiring such coverage doesn’t always hinge on licensing status.

Freelancers should explore options that welcome non-licensed professionals, allowing those without formal credentials access essential protection. Many organizations specialize in tailoring policies for various freelance sectors, guaranteeing appropriate coverage.

Understanding specific professions necessitates looking at services offered, ensuring adequate protection exists against professional shortcomings or misunderstandings arising during service delivery.

Insurance Platforms & Comparison Tools

Online Comparison Tools

Insurance market complexities may deter individuals from exploring various options. Thankfully, numerous online platforms make navigating this process more manageable. Such comparison tools evaluate multiple quotes, simplifying selection processes, even for those without a license.

Using these resources allows users direct access to diverse offerings, permitting informed decision-making in choosing appropriate coverage options that align with personal circumstances. Ensuring comprehensive comparisons guarantees optimal policy choices.

On top of that, many of these platforms offer insightful reviews & customer testimonials, highlighting satisfied customers alongside showcasing pitfalls linked with certain insurers.

Engaging Insurance Agents

Individuals unsure about navigating insurance options without a license often benefit from consulting licensed agents. Professionals in this space can provide tailored advice & insights relevant to different product offerings effectively.

Finding an agent specializing in non-traditional insurance avenues increases chances of uncovering suitable alternatives. Personalized guidance fosters confidence among individuals while addressing queries & concerns linked with navigating various policies.

And another thing, some agents may offer flexible arrangements when showcasing multiple providers, allowing prospective buyers access to various market opportunities without requiring a license.

Exploring Specific Insurance Options

Health Coverage Comparison Table

| Policy Type | Coverage Offered | Eligibility Requirements |

|---|---|---|

| Marketplace Plan | Medical, dental, & preventive services | No license required; income-based eligibility |

| Medicaid | Comprehensive health coverage | Income qualifications; no license needed |

| Private Health Insurance | Flexible coverage options | No license requirement |

Car Insurance Options Available

- Non-owner car insurance

- Specialty insurer policies

- Temporary car insurance plans

- Non-licensed driver exclusions

- Rental car coverage

Pet Insurance Comparison Table

| Provider | Plan Type | Coverage Features |

|---|---|---|

| Healthy Paws | Comprehensive plan | Illnesses, accidents, & genetic conditions |

| Petplan | Accident & illness plan | Routine care options available |

| ASPCA | Accident-only plan | Basic coverage for accidents |

Understanding Your Rights as a Non-licensed Individual

Insurance Rights Overview

Navigating insurance realms often comes with many unspoken rights, especially for those lacking a license. Individuals must understand their entitlements while seeking various insurance options, which can prove invaluable during procurements.

Insurance companies should not deny individuals access to products solely based on licensing status. Rather understanding personal situations regarding coverage allows individuals better opportunities while searching for policies.

Becoming well-versed in consumer protection laws across states aids individuals in advocating for themselves when navigating coverage options. Knowledge of these rights creates confidence while evaluating various products, driving informed decisions.

Negotiating Insurance Terms

Understanding insurance rights also leads toward improved negotiation tactics. Individuals without licenses can attempt negotiations around premiums, coverage inclusions, or exclusions without reverting to previous assumptions regarding their eligibility status.

Many insurers possess flexibility relating specifically towards premiums based on individual needs & risks. Thus, open discussion surrounding unique situations proves beneficial for securing suitable policies while maintaining affordability.

Individuals should prioritize presenting comprehensive personal information regarding their specific circumstances & preferences. This can lead to fruitful conversations & better agreement terms when discussing insurance options.

The Importance of Research & Awareness

Benefits of Researching Your Options

Effective research serves as a cornerstone when pursuing insurance options without requisite licensing. Conducting assessments empowers individuals with knowledge, providing a clearer understanding of products tailored for their needs.

Many resources exist online, highlighting specific offerings relevant for those without a license. Such resources include websites, forums, & guides designed to assist individuals navigating the insurance landscape.

Diving deep into the subject lessens confusion surrounding available choices, opening doors towards accessing suitable options tailored for unique circumstances regardless of licensing status.

Staying Informed & Updated

Staying informed remains paramount, especially in dynamic sectors like insurance. New policies frequently emerge, while regulations might shift, affecting coverage eligibility. Regularly engaging with dedicated insurance resources fosters awareness while spotlighting recent industry changes.

Mixing both online & offline resources including networking events, workshops, & community discussions contributes toward comprehensive awareness. Staying connected enhances learning while solidifying reputations within insurance arenas.

Awareness of consumer rights alongside updated offerings keeps individuals equipped while pursuing coverage options, further reinforcing confidence while selecting policies.

Looking for insurance options without a license? Discover what you can get & how to protect yourself easily, even without a driving permit!

Conclusion

When it comes to what insurance you can get without a license, there are still some good options available. You might consider things like health insurance, accident insurance, & even . These can provide financial protection in case of unexpected events. Just remember, certain types of coverage, like auto insurance, typically require a license. It’s always a good idea to shop around, compare plans, & ask questions to find what works best for you. So, take your time & make sure you’re getting the right coverage that fits your needs!