To unlock peace of mind in auto insurance, start by assessing your needs & budget, then research multiple providers for coverage options & customer reviews. Utilize comparison tools to identify the best policies & rates, focusing on liability, collision, & comprehensive coverage. Gather quotes from various insurers & inquire about discounts for safe driving or bundled policies. Finally, read the fine print to understand terms & conditions before making your choice, ensuring you select a policy that provides the protection you need while fitting comfortably within your financial plan.

Unlocking Peace of Mind: A Step-by-Step Guide to Finding the Best Auto Insurance for You!. Discover how to unlock peace of mind with our step-by-step guide to finding the best auto insurance for you! Easy tips & helpful advice await!

Defining Your Auto Insurance Needs

Understanding personal needs regarding auto insurance can significantly impact choices made. Every individual, vehicle, & circumstance offers unique elements requiring careful consideration. Different factors must propel decisions—mileage, vehicle age, driving habits, & even location are important aspects influencing insurance requirements.

For individuals who drive frequently for long distances, comprehensive coverage usually becomes essential. Conversely, people with older vehicles might prioritize basic liability insurance options, where costs generally remain lower. Identifying these personal characteristics plays a vital role in establishing a strong foundation for auto insurance selection, ultimately unlocking peace of mind.

And another thing, understanding different coverage types like collision, comprehensive, & liability can further guide decisions. Each coverage type possesses specific functions, allowing for tailored solutions catering to personal & vehicle specifications. Knowing what each option entails empowers individuals, enabling them to make informed choices.

Researching Various Insurance Providers

After setting clear personal insurance needs, next step encompasses researching various providers actively. Numerous companies offer varying products, making extensive research crucial. Reading customer reviews, exploring online resources, & comparing provider ratings can yield a wealth of valuable insights.

Utilizing websites dedicated to comparing auto insurance rates also allows individuals to gauge what competitors offer. Ensure familiarity with local insurance regulations or requirements specific to your state. Every region tends to have its rules affecting premiums, coverage options, & overall offerings, providing additional factors needing consideration during research.

Establishing direct communication with potential providers can also shed light on distinctive features available. Engaging agents or customer service representatives fosters an understanding of coverage options, discounts, & customer service quality. This research phase ultimately assists in narrowing choices while identifying highest-rated options available.

Comparing Policy Quotes

Gathering & comparing policy quotes becomes a pivotal step in securing ideal auto insurance. Providers typically offer online tools enabling individuals to obtain quotes based on provided information. Ensure that each quote encompasses similar coverage types & deductibles for accurate comparisons.

In addition, examining hidden fees or exclusions associated with certain policies proves crucial. Discerning precise terms & conditions can reveal underlying costs or circumstances leading to unexpected expenses later. Overall, an apples-to-apples comparison of quotes helps unveil best options available in an individual’s budget range.

While comparing quotes, consider potential discounts that companies may offer. Discounts for safe driving, bundling policies, or vehicles equipped with advanced safety features often become significant money-savers. Understanding these nuances enhances chances of finding a policy tailored for affordability & efficient coverage.

Understanding Key Coverage Types

Grasping various auto insurance coverage types constitutes an essential aspect of informed decision-making. Key types include collision, comprehensive, personal injury protection, & liability coverage. Each category addresses specific situations, providing a safety net for unforeseen circumstances.

Collision coverage addresses damages incurred during accidents with other vehicles or objects. It plays a crucial role for those with newer, high-value vehicles, ensuring financial protection even in unfortunate circumstances. Houses & belongings are generally not covered under this category, making awareness essential.

On another hand, comprehensive coverage takes care of damages from non-collision incidents such as theft, vandalism, or natural disasters. Those living in areas prone to extreme weather events might find comprehensive coverage more beneficial, ensuring broader protection. Understanding these foundational components prepares individuals for better decision-making processes.

Evaluating Deductibles & Premiums

Deductibles & premiums form significant elements within any auto insurance policy. Recognizing their implications provides further clarity when selecting a suitable coverage plan. A deductible expresses an amount individuals agree to pay out-of-pocket before insurance coverage kicks in, greatly impacting monthly premium rates.

Typically, a higher deductible allows for lower premium rates. Be that as it may, this scenario requires individuals to assess their financial readiness should an accident or damage occur. On another side, a lower deductible appears attractive but often raises monthly premium costs. Striking a balance based on personal financial situations serves as key to unlocking peace of mind.

On top of that, evaluating overall costs associated with premiums leads individuals towards making sound financial decisions. Conducting comprehensive evaluations empowers individuals, laying groundwork toward clearer understanding of annual costs versus deductible responsibilities. Such insights yield a better financial plan while navigating insurance options efficiently.

Taking Advantage of Discounts

Many insurance providers offer numerous discounts, creating opportunities for significant savings. Understanding eligibility for such discounts can enhance overall satisfaction with chosen policies. Popular discounts often include those for safe driving records, multiple vehicle policies, or bundling home & auto insurance.

And another thing, discounts based on student status or participation in specific safety courses add further options for savings. Maintaining proactive communication with providers encourages awareness of newer or expiring discounts. Every potential saving contributes substantially towards minimizing overall insurance costs & optimizing budget allocations.

Establishing an open dialogue with an insurance agent can also reveal personalized discounts. Agents can provide insights on ongoing promotions or lesser-known opportunities based on individual circumstances. Taking active steps in leveraging available discounts results in smoother financial management while keeping coverage robust.

Utilizing Technology for Better Choices

Advancements in technology serve an integral role in modern auto insurance purchasing processes. Many insurance companies provide digital platforms & mobile apps that simplify research & communication efforts. These tools help individuals manage their policies efficiently while keeping up with changes in coverage or terms.

On top of that, utilizing comparison websites or apps offers straightforward means of obtaining multiple quotes, assisting in visualizing premium differences effectively. Constantly monitoring trends in auto insurance, especially through tech tools, enables individuals to stay updated on available coverage improvements or changes in rates.

Benefits also extend towards online claims filing processes, which can result in quicker resolutions coupled with improved customer service. Many providers have evolved with changing technology, ensuring policies remain accessible while reinforcing efficiency. Lower wait times & streamlined processes amplify customer satisfaction during crucial moments.

Understanding Your Rights & Responsibilities

Fostering an awareness of rights & responsibilities associated with auto insurance becomes imperative. Familiarizing oneself with local regulations empowers individuals, ensuring compliance while harnessing specific rights when navigating claims or disputes. Every state maintains distinct laws regarding minimum coverage requirements, warranties, & overall obligations.

And don’t forget, understanding rights during claim settlements fortifies peace of mind, especially while dealing with unexpected incidents. Reviewing policy documents carefully allows individuals greater insight into coverage specifics, ensuring no surprises arise during stressful scenarios. Knowledge in these areas enables individuals to approach insurance confidently.

Lastly, being well-informed about provider responsibilities also serves crucial purposes. This knowledge provides leverage during claim denials or disagreements, allowing for persuasive dialogue with adjusters or agents. Understanding both individual rights & insurer responsibilities cultivates a sense of empowerment throughout auto insurance obligations.

Feature List of Unlocking Peace of Mind: A Step-by-Step Guide to Finding the Best Auto Insurance for You!

- 🛡️ Personalized coverage options

- 📊 Comparative analysis of quotes

- 🧾 Understanding key coverage types

- 💰 Potential discounts availability

- 📱 Technology-enhanced processes

- 📝 Clear understanding of rights & responsibilities

- 🌟 Comprehensive research strategies

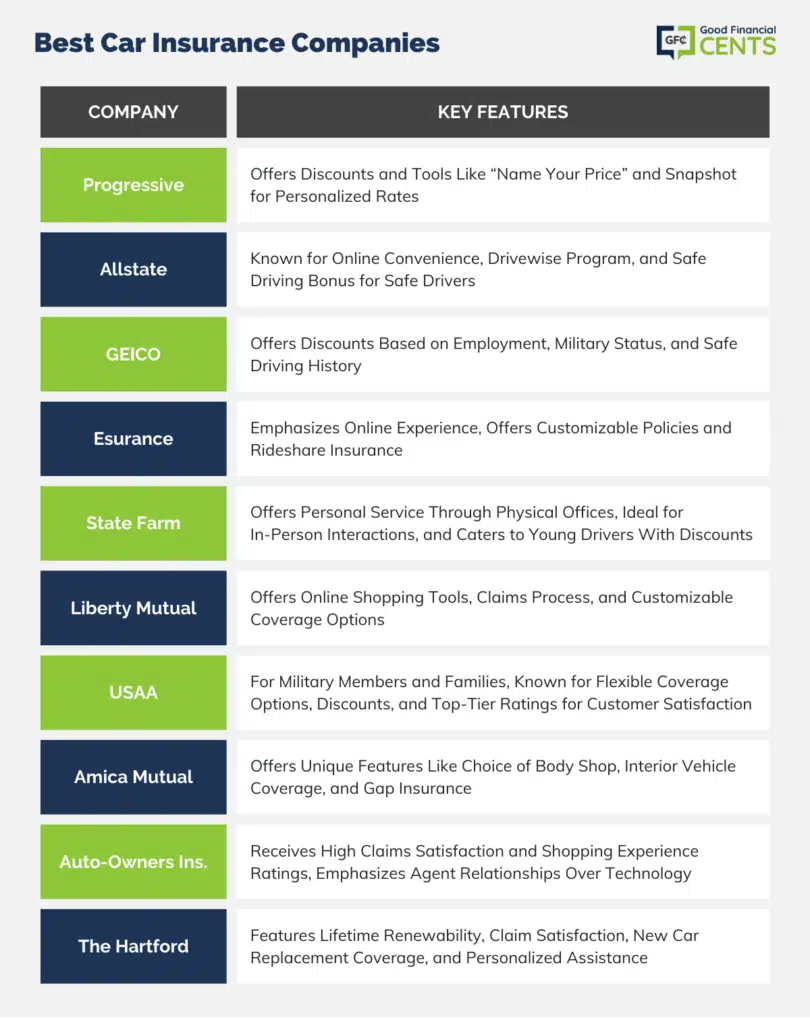

Comparative Table of Auto Insurance Providers

| Provider | Coverage Options | Discounts Available | Customer Rating |

|---|---|---|---|

| Provider A 🏆 | Basic & Comprehensive | Safe Driving, Multi-Policy | 4.5/5 |

| Provider B 🔥 | Liability & Collision | Student, Bundling | 4.0/5 |

| Provider C 💎 | Comprehensive Only | Military, Safety Course | 4.8/5 |

| Provider D 🌈 | Full Coverage | Online Quote Discounts | 4.3/5 |

“Finding suitable auto insurance provides not only financial security but also enhances overall peace of mind.” – Anonymous

My experience in unlocking peace of mind through finding best auto insurance involved countless hours researching options, gathering quotes, & ultimately navigating a sometimes overwhelming array of choices. By breaking down each component, I felt more confident about making informed decisions that aligned with my needs.

Discover how to unlock peace of mind with our step-by-step guide to finding the best auto insurance for you! Easy tips & helpful advice await!

Conclusion

Finding the right auto insurance doesn’t have to be stressful. By following this simple guide, you can **unlock peace of mind** & choose the best coverage for your needs. Remember to assess your requirements, compare quotes, & read reviews to make an informed decision. Don’t hesitate to ask questions & seek guidance if you’re unsure about anything. With a little bit of effort, you’ll secure the best auto insurance that keeps you safe & sound on the road. So, take a deep breath, & enjoy the journey of **finding the best auto insurance for you**!