Yes, getting insurance quotes online is generally safe, provided you use reputable websites. Leading insurance companies & comparison platforms employ robust encryption & security measures to protect your personal information. Always check for secure website indicators, such as “https” in the URL, & read reviews about the site before submitting any details. And another thing, consider limits on the information you provide & ensure you understand privacy policies to safeguard your data.

is it safe to get insurance quotes online. Wondering if it’s safe to get insurance quotes online? Discover tips for secure browsing & expert advice for a worry-free experience.

Understanding Online Insurance Quotes

Gaining insights about insurance products can be daunting. Be that as it may, utilizing online platforms helps facilitate step towards an informed decision. While exploring various options, one might wonder about safety involved during such interactions. Can privacy remain intact? Are risks associated? Understanding these aspects becomes pivotal while seeking insurance quotes online.

The Convenience of Online Insurance Quotes

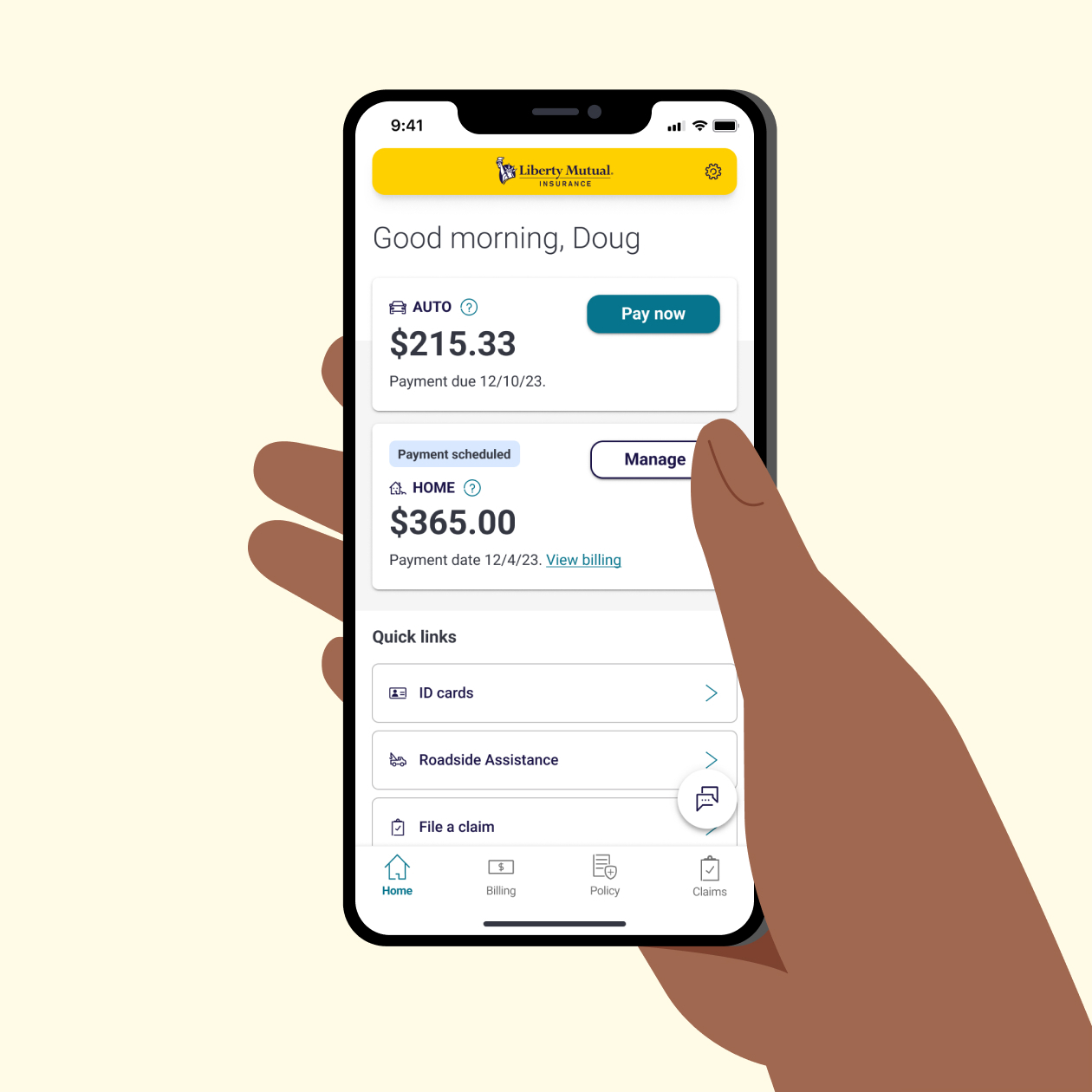

Accessing insurance quotes online brings exceptional convenience. A single click reveals numerous providers & their offerings. Rather than visiting physical locations or waiting on hold, individuals enjoy instant access. Compare features, prices, & terms all at one cohesive interface. This accessibility encourages consumers to be more engaged within their choices.

While navigating various websites, users have flexibility to seek multiple options. Many platforms allow customization, enabling personalized quotes tailored around specific needs. Thus, this approach accelerates processes that once demanded considerable time & effort.

On top of that, most platforms feature user-friendly interfaces designed explicitly for customer ease. Graphical representations alongside simple language ensure that everyone comprehends available data. All contribute towards enhancing overall experience, making insurance procurement less tedious.

Privacy Concerns When Seeking Quotes

Remaining cautious about privacy concerns stands fundamental during online activities. Many individuals worry about sharing personal information. Addressing specific data insecurity issues helps ease apprehensions surrounding online inquiries for potential insurance quotes.

Prioritize engaging with reputable companies known for stringent security protocols. Look for clear policies detailing how companies handle sensitive data. Verify whether they utilize encryption methods prolonging protected communication channels. These measures reduce chances of unauthorized access.

Aside from choosing trustworthy platforms, individuals should employ basic cybersecurity practices. Utilizing strong passwords, regularly updating them, & refraining from sharing information via insecure networks enhance personal safety. Understanding these practices elevates confidence, minimizing fears regarding sharing necessary information.

Identifying Reputable Insurance Providers

Navigating vast landscape of online insurance quotes requires discernment. Identifying trustworthy providers warrants careful consideration. An array of platforms exist, Be that as it may, not *all* possess equal reliability. Research becomes vital when determining credibility & legitimacy.

Consider checking for valid licenses & accreditations, which signify adherence & compliance with regulations. And another thing, reading customer reviews & ratings offers valuable perspectives about overall experiences with certain insurers. Each insight provides critical knowledge about how well these providers interact with clients.

And don’t forget, connect with local insurance agents familiar with online platforms. They can steer you towards reputable sources while affirming safety protocols. By leveraging diverse strategies, securing trustworthy insurance avenues becomes significantly easier.

The Role of Reviews & Ratings

In choosing providers, online reviews & ratings play an integral role. Customers’ experiences provide essential insights regarding various companies. A high rating on quality serves as a strong indicator of excellence, financial stability, & efficiency.

Analyze specific feedback often left by past customers regarding claims processes, customer service interactions, & overall satisfaction levels. Such details unveil trends that may inform future decisions regarding desired insurers. Understanding general sentiments around providers further reinforces selection criteria.

Be that as it may, remain vigilant while interpreting reviews. Some may reflect personal biases rather than objective evaluations. Always scrutinize multiple sources before reaching conclusions based solely on singular narratives.

How Quotes are Calculated Online

Online platforms utilize numerous variables while calculating insurance quotes. Each insurer employs distinct algorithms & data points tailored around customer profiles for predictions. Common factors include age, gender, location, & driving history for auto insurance, among others.

Understanding these calculations fosters transparency in pricing structures. Individuals must ascertain how each parameter contributes towards overall costs associated with various plans. This knowledge empowers consumers with the ability to make better choices based on unique preferences.

And don’t forget, factors influencing rates continue evolving due to technological advancements within industry frameworks. Emerging tools such as artificial intelligence analyze patterns, offering even more personalized quotes. Staying informed about these shifts provides strategic advantages during research & decision-making phases.

How to Protect Personal Information Online

Protecting personal information during online inquiries remains of utmost importance. Several strategies exist aimed at safeguarding sensitive data effectively. First, always utilize secure connections while browsing. Only interact with websites exhibiting SSL certificates, indicated by ‘https://’ in their URLs.

Second, refrain from providing unnecessary details unless warranted. Essential information may include name, email address, & phone number; Be that as it may, avoid sharing specifics like Social Security numbers unless *absolutely* required. This approach mitigates risks of identity theft.

And another thing, consider utilizing virtual private networks (VPNs) when conducting sensitive transactions. Such tools establish secure communication channels while shielding your online presence from prying eyes. Adopting these practices elevates overall safety while pursuing insurance quotes online.

Understanding Terms & Conditions

Before proceeding with any online quotes, reading terms & conditions becomes critical. Many users neglect scrutinizing these documents; Be that as it may, doing so unveils potentially hidden facts regarding eligibility, cancellation policies, & fee structures. Each element can dramatically impact overall purchase decisions.

And another thing, terms often outline specific obligations expected from both parties involved. Understanding respective rights clarifies responsibilities associated with contracts. Many individuals overlook these details, leading to assumptions that may distort expectations about coverage agreements.

In order to avoid pitfalls, take time reviewing all documents thoroughly before acceptance. Engaging with customer service representatives may explain areas that remain unclear. Taking these proactive measures ensures confidence in every transaction.

Affordable Insurance Solutions Online

Individuals seeking affordable insurance solutions have countless opportunities available online. Many sites compare quotes across various providers, identifying best deals without sacrificing quality. This effortless comparison significantly reduces time spent searching.

And another thing, many companies offer exclusive discounts for online inquiries or sign-ups. Viewing such offers could yield substantial savings, allowing consumers an economical route while fulfilling their insurance needs. Researching multiple platforms enhances potential savings further.

And don’t forget, individuals also possess the ability to customize their policies according to personal budgets during these online searches. Many insurers facilitate creating packages tailored around financial capacities, promoting affordability & accessibility.

Overall Assessment of Safety in Online Quotes

Evaluating overall safety regarding online quotes necessitates keen observation & thorough research. While myriad risks exist, prioritizing transparency amidst reputable providers significantly mitigates them. Embracing sound security practices while leveraging technology helps safeguard personal information.

Equipped with tools & insights available online, individuals can confidently navigate insurance landscapes even amidst uncertainties. Establishing trust through understanding enables individuals ultimately to make informed decisions regarding their insurance needs.

Key Considerations for Safety

- Choose reputable companies with strong security measures.

- Utilize secure connections & refrain from sharing excessive information.

- Read & understand terms & conditions thoroughly before agreeing.

- Leverage reviews & ratings as part of decision-making.

- Engage with local agents for recommendations on reliable providers.

Next Steps After Receiving Quotes

Upon receiving various online quotes, evaluating & comparing options allows determining best fit. Individuals should create a checklist regarding primary features such as cost, coverage limits, exclusions, & claims handling. This methodical approach clarifies preferences & explores potential alternatives.

Take time to re-evaluate previous experiences linked with insurance providers. Analyses reveal patterns that merit consideration, influencing satisfaction directing future decisions. Each experience contributes towards understanding which characteristics prove most important during selection.

Engaging with customer service supports generating answers to outstanding questions. Efficient communication channels help confirm concerns regarding specifics within quotes or other details. Remaining proactive throughout process cultivates confidence regarding choices made.

Self-Experience with Online Quotes

Searching for adequate insurance quotes online proved seamless during my experience. I approached reputable sites that provided comprehensive comparisons. Utilizing their intuitive interfaces made navigating options straightforward, allowing me to explore myriad possibilities.

And another thing, safeguarding personal data along the way became paramount. I ensured every platform utilized secure protocols, verifying encryption methods present prior entering any sensitive information. Such steps helped me feel confident throughout process.

Ultimately, obtaining quotes online led towards optimal affordability without sacrificing quality. Engaging with various providers had served incredibly beneficial while uncovering hidden discounts & tailoring policies according to individual needs.

| Provider | Quote Amount | Main Coverage Type |

|---|---|---|

| Provider A | $800 | Comprehensive |

| Provider B | $750 | Liability |

| Provider C | $700 | Collision |

Additional Safety Measures

- Enable two-factor authentication wherever possible.

- Keep security software updated on devices used for online inquiries.

- Regularly review & monitor your financial statements for suspicious activities.

- Be cautious of unsolicited communication requesting sensitive data.

- Utilize credit monitoring services to detect potential fraud early.

| Feature | Importance |

|---|---|

| Encryption | Prevents unauthorized access |

| Reputation | Indicates reliability & trustworthiness |

| Customer Reviews | Provides insights into overall satisfaction |

Final Steps Before Committing

Before finalizing any choices regarding insurance quotes, ensure comprehensive understanding of selected policies. Reviewing documents carefully allows individuals to be well-informed about coverage limits, exclusions, & premium payments. Such diligence cultivates confidence necessary when making significant financial commitments.

Don’t hesitate requesting clarifications surrounding any ambiguous language present. Engaging directly with customer service allows eliminating confusion, ensuring all parties understand terms exactly. Having clarity reduces potential disputes arising later down line.

Ultimately, establishing a solid foundation built on research helps eliminate uncertainty while pursuing adequate insurance solutions. Consideration towards safety remains paramount as individuals navigate pathways within digital realms.

“Safety while obtaining insurance quotes online hinges upon consumer choice, vigilance, & understanding.” – Anonymous

| Insurance Type | Average Online Quote | Time Taken |

|---|---|---|

| Auto Insurance | $900 | 10 minutes |

| Home Insurance | $1,200 | 15 minutes |

| Health Insurance | $400 | 20 minutes |

Considerations for Future Insurance Needs

- Assess changing circumstances which may influence coverage needs.

- Revisit & compare quotes annually for potential savings.

- Stay updated about new providers & emerging technologies enhancing processes.

- Continually educate yourself regarding industry changes & innovations.

- Maintain open communication lines with insurance agents for ongoing updates.

Wondering if it’s safe to get insurance quotes online? Discover tips for secure browsing & expert advice for a worry-free experience.

Conclusion

Getting insurance quotes online can be a safe & convenient option for many people. By following some simple guidelines, such as using trustworthy websites & protecting your personal information, you can enjoy the benefits of quick comparisons & competitive pricing. Remember to read reviews & check for proper licensing before sharing any sensitive data. Overall, it’s a practical way to find the best coverage for your needs without stepping outside your home. Just stay smart & cautious, & you’ll likely have a positive experience getting your insurance quotes online.