To get started as an insurance adjuster, research your state’s licensing requirements, as many require certification or training programs. Consider enrolling in a reputable adjuster training course to gain fundamental knowledge of insurance policies, claims processes, & industry regulations. Networking with experienced adjusters & joining professional organizations can provide valuable insights & job leads. And another thing, seeking entry-level positions or internships can offer hands-on experience. Once licensed, continuously stay updated on industry trends & best practices to advance your career effectively.

how to get started as an insurance adjuster. Ready to dive into a career as an insurance adjuster? Discover simple steps to get started, from education to licensing & gaining experience!

:max_bytes(150000):strip_icc()/Term-Definitions_Independent-insurance-adjuster---recirc-af2be22193204a1cae061b701507ca2e.jpg)

Understanding Insurance Adjuster Roles

An insurance adjuster plays a crucial role within claims processing. They investigate claims, assessing damage, & determining coverage. Adjusters need strong analytical skills, attention to detail, & interpersonal communication abilities. Daily tasks involve collecting evidence, interviewing claimants, & collaborating with various stakeholders, such as insurance company representatives, medical professionals, & legal experts. Their work often requires travel to accident sites, homes, or businesses where claims originate.

Adjusters may specialize in various fields, including property, auto, or liability insurance. Each area requires specialized knowledge to navigate specific regulations & procedures. Beyond technical skills, adjusters must possess empathy, as they often work with clients facing stressful situations after accidents or unforeseen events. Building rapport creates trust, facilitating smoother claim processing. Sound judgment remains essential for determining settlement amounts & ensuring fair outcomes for all parties involved.

Individuals pursuing this career will find opportunities both as employees within companies or as independent contractors. Different paths each have unique demands & rewards. Understanding these distinctions guides new professionals in making informed decisions about career preferences & long-term goals within this dynamic industry. A successful insurance adjuster embraces continuous learning, keeping up with industry trends, regulations, & best practices.

Required Education & Training

Most **insurance adjuster** positions require a minimum of a high school diploma; Be that as it may, many employers prefer candidates with an associate’s or bachelor’s degree. Degrees in **business**, **finance**, or **risk management** provide a solid foundation for understanding complex insurance concepts. Various community colleges & universities offer specialized programs tailored towards guiding students through coursework specifically relevant to insurance claims & adjusting.

In addition, completion of training programs or certification courses can significantly enhance one’s qualifications. Many insurers provide internal training focusing on company policies & procedures, which can be immensely beneficial for newcomers. Various organizations offer certification programs, such as the National Association of Independent Insurance Adjusters (NAIIA) & the American Institute for Chartered Property Casualty Underwriters (CPCU). Earning certifications from reputable bodies elevates a resume.

Ongoing education remains critical in this profession. Adjusters should seek opportunities for professional development, attending workshops, conferences, & webinars to stay updated. Staying informed about emerging trends, new insurance products, or changes in regulations ensures both compliance & competitiveness in an ever-evolving field. Embracing lifelong learning reflects positively on one’s career trajectory.

Navigating Licensing Requirements

Each state mandates specific licensing requirements for insurance adjusters, which can vary substantially. Thus, checking local regulations before starting a career remains essential. Some states may require applicants to pass an examination, demonstrating knowledge of insurance laws, claims processes, & ethical practices. Others might require completion of pre-licensing courses covering similar topics.

Generally, applicants must submit an application alongside payment of a licensing fee. Background checks may also accompany this application process. Many states have reciprocity agreements; therefore, adjusters holding licenses from one state may obtain licenses in others without retaking exams. Familiarity with local laws ensures compliance & adherence to ethical standards while maintaining one’s license.

Once licensed, maintaining certification involves fulfilling continuing education requirements. Adjusters may need to complete additional courses within designated timeframes. Understanding local regulations not only safeguards a career but also showcases professionalism when interacting with clients. Knowledge of licenses helps adjusters support their clients through the claims process with greater confidence.

Gaining Hands-on Experience

Entering this profession often involves securing an entry-level position within an insurance company or a claims management firm. Gaining hands-on experience equips newcomers with practical skills necessary for long-term success. Internships, apprenticeships, or trainee programs allow individuals to learn from seasoned professionals while observing daily operations & responsibilities involving insurance claims.

Often, mentorship remains a valuable resource during this learning phase. Partnering with experienced adjusters provides insights into best practices, navigating complexities inherent within claims processing. Regular communication with mentors regarding challenges helps accelerate learning. Participating in discussions fosters confidence while refining one’s skills in real-world settings.

Beyond formal roles, volunteering for projects involving insurance or related fields can enhance competence. Joining professional associations or networking events opens doors; connecting with peers helps broaden industry knowledge. Actively engaging with peers fosters collaboration while creating opportunities for career advancement. Networking remains critical across various stages of an adjuster’s career.

Developing Analytical & Communication Skills

Analytical skills prove vital within this profession, as assessors evaluate evidence, analyze damages, & calculate settlement amounts. Developing a keen eye for detail contributes towards uncovering discrepancies or fraudulent claims. Strong critical thinking enables accurate assessments of complex situations, ensuring fair treatment for all parties involved throughout the claims process.

Communication abilities are equally crucial, as adjusters must frequently articulate findings clearly & effectively. Writing detailed reports & discussing sensitive topics surrounding losses creates an essential skill set necessary for success. Adjusters often communicate with clients, agents, & repair professionals; therefore, possessing excellent interpersonal skills enhances relationships built throughout claim resolution.

Practicing both verbal & written communication skills assists adjusters when presenting cases before stakeholders or negotiating settlements. Engaging in public speaking workshops, joining local clubs, or participating in training sessions enhances essential capabilities. Investing time into improving these skills proves beneficial long after entering this career.

Exploring Different Types of Insurance Adjusting

Various types of **insurance adjusting** exist, each with unique responsibilities & requirements. Property adjusters primarily focus on losses related to homes, businesses, & personal property. Their role involves assessing damages from natural disasters, accidents, or vandalism while determining policy coverage. Technical knowledge regarding building materials & repair procedures proves invaluable in this specialization.

Auto adjusters handle claims related to vehicle accidents. Evaluating damages, interviewing involved parties, & verifying coverage details comprises their daily tasks. Understanding automotive repair processes & estimating costs for damages becomes necessary for effective claims resolution. Proper negotiation skills ensure fair settlements for all parties.

Liability adjusters investigate claims related to accidents or injuries where liability must determine. Understanding personal injury laws, medical terminology, & relevant regulations remains crucial. This adjusted type often collaborates with lawyers & medical professionals, showcasing how a multi-faceted approach benefits all say involved. Gaining exposure across various adjusting fields can cultivate broad expertise.

Networking within the Industry

Building a network remains integral for **insurance adjusters**, facilitating career advancement & establishing useful connections. Engaging with professionals within the industry allows newcomers access to valuable knowledge & expertise. Attending conferences, seminars, & industry events provides opportunities for expanding one’s network while learning about innovative practices shaping adjusting today.

Actively participating in industry associations can enhance credibility & visibility among peers. Joining working groups or committees allows individuals to contribute directly while showcasing skills. Mentorship opportunities arise frequently within such organizations, enabling newer professionals to learn from seasoned veterans. Developing relationships within this network can lead to potential job opportunities or collaborations in future projects.

Participating in online communities, such as forums or social media groups dedicated to claims adjusting, fosters connections with peers around the world. Sharing insights & experiences helps individuals remain informed about industry trends while connecting with like-minded professionals. Engaging in these spaces provides additional learning avenues while strengthening professional relationships across wider networks.

Understanding Compensation & Job Expectations

Compensation within this profession varies based on a variety of factors; geographical location, experience level, & specialization all play significant roles. Adjusters may receive salaries, hourly wages, or commission-based compensation based on volume of claims processed. Becoming a successful adjuster requires diligence, balancing workload while maintaining quality in assessment & customer service.

Standard job expectations involve maintaining a high level of professionalism, adherence to ethical standards, & exceptional communication abilities. Adjusters routinely manage multiple claims simultaneously requiring efficient organizational skills. Remaining proactive regarding deadlines keeps workflow on track while ensuring client satisfaction remains priority.

And another thing, successful adjusters demonstrate resilience & adaptability. The nature of this role presents ever-changing challenges & unpredictable work environments. Remaining composed under pressure while thinking critically allows for effective resolution of complex disputes. These traits define successful professionals in this field, paving a promising career path ahead.

Staying Informed about Industry Trends

As with many professions, staying informed about changes in **insurance** regulations, emerging technologies, & evolving consumer expectations proves essential. Industry publications, podcasts, & webinars serve as valuable resources for education & networking opportunities. Actively engaging with these mediums ensures understanding of shifts within this dynamic field, enabling adjusters to remain up-to-date & relevant.

Emerging technology impacts claims processing & management, making it imperative for adjusters remain adaptable. Tools such as claims management software & mobile applications streamline processes while enhancing communication between all parties involved. Familiarity with these advances contributes positively to overall performance & increases efficiency within claim handling.

And another thing, following thought leaders on social media or participating in online forums dedicated to adjusting cultivates awareness of innovative ideas & practices being adopted throughout various organizations. Actively engaging with peers allows insights into how different teams approach similar challenges, fostering a collaborative learning environment within this profession.

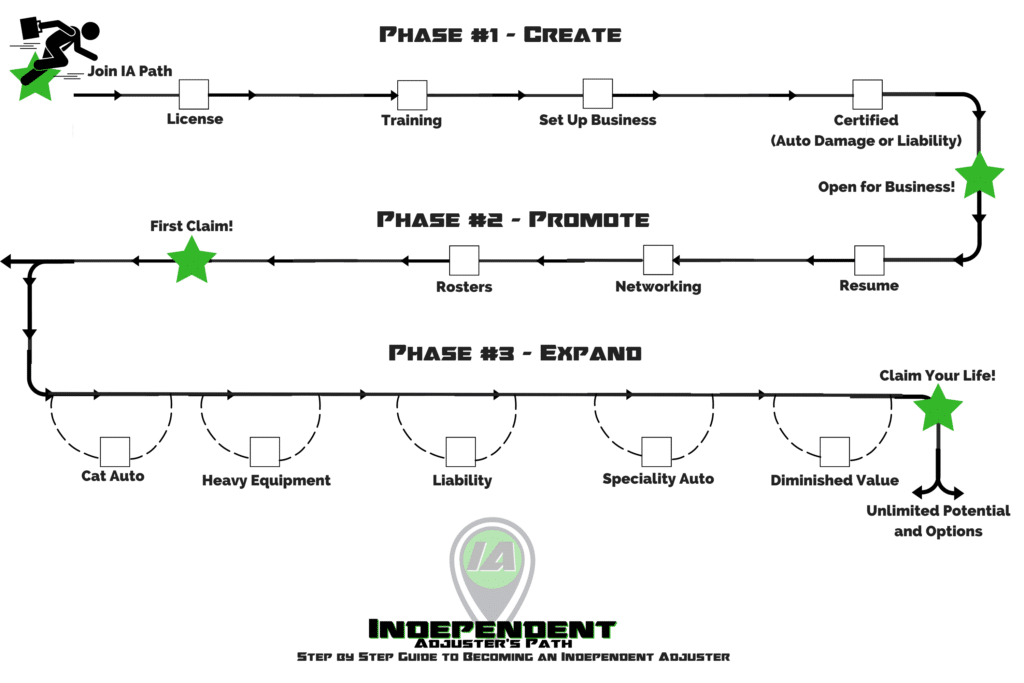

Exploring Self-Employment as an Adjuster

In addition to working for established companies, **insurance adjusters** may choose self-employment or contract work. This career path offers flexibility & the potential for increased income based on performance. Independent adjusters often work directly with clients or insurers, facilitating claims management while maintaining control over their schedule & workload.

Self-employment presents unique challenges, requiring strong marketing & business management skills. Establishing a solid reputation & network often involves extensive promotion & providing exceptional service consistently. Successful independent adjusters cultivate relationships with insurance companies seeking freelance adjusters, enhancing opportunities for landing contracts.

And don’t forget, independent adjusters maintain more control over work-life balance. Working on various contracts allows for diverse experiences, often leading to increased job satisfaction. While self-employment offers benefits, it’s essential to remain disciplined to manage workload effectively while delivering high-quality services efficiently.

Short Guides for Getting Started as an Insurance Adjuster

Essential Steps for Aspiring Insurance Adjusters

- Obtain necessary education & training.

- Pass licensing examination specific to your state.

- Seek entry-level positions for practical experience.

- Develop analytical & communication skills.

- Network within industry associations & events.

Professional Development Tips

- Enroll in specialized training courses.

- Engage in local insurance community events.

- Attend seminars focusing on emerging trends.

- Seek mentorship from experienced adjusters.

- Stay updated on industry regulations through newsletters.

Overall Career Growth Considerations

- Explore various types of adjusting specializations.

- Consider opportunities for self-employment.

- Stay informed about technologies impacting claims management.

- Enhance negotiation skills through professional workshops.

- Commit to continuous education & certification renewal.

Strategies for Successful Negotiation

Negotiation skills remain critical as an adjuster manages client expectations while working towards optimal settlements. Approaching negotiations with empathy & understanding builds rapport with clients. Establishing a foundation of trust aids in reaching satisfactory resolutions, especially during disputes or disagreements. Adjusters must articulate facts clearly, providing a comprehensive view of the situation based on detailed evidence gathered.

Employing active listening techniques allows adjusters to understand clients’ concerns fully. This method recognizes clients’ emotions, addressing any apprehensions while demonstrating commitment towards fair & timely resolutions. By validating the client’s perspective, adjusters maintain an open communication channel conducive for effective negotiation. Accurate documentation of all discussions ensures information remains clear, serving as a point of reference throughout negotiations.

And another thing, developing effective persuasive techniques becomes crucial during negotiations. Presenting concise, fact-based arguments reinforces an adjuster’s position while demonstrating expertise within the field. Remaining flexible & willing to explore alternatives increases chances for mutually beneficial outcomes. Successfully negotiating settlements enhances reputation while fostering longer-lasting relationships with clients & other partners involved.

| Adjuster Type | Average Salary | Experience Level |

|---|---|---|

| Property Adjuster | $60,000 | Entry to Mid-Level |

| Auto Adjuster | $58,000 | Mid to Senior-Level |

| Liability Adjuster | $65,000 | Senior-Level |

“Starting a career as an insurance adjuster demands both commitment & a willingness for continuous learning, but rewards await those who invest in their development.”

Ready to dive into a career as an insurance adjuster? Discover simple steps to get started, from education to licensing & gaining experience!

Conclusion

Getting started as an insurance adjuster can be a rewarding career choice. To dive in, begin by researching the educational requirements & any necessary licenses for your state. Consider enrolling in a training program to build your skills. Networking with experienced adjusters can also provide valuable insights & guidance. Once equipped with knowledge, start applying for entry-level positions to gain hands-on experience. Remember, patience & persistence are key as you navigate this path. With time & dedication, you’ll be well on your way to a successful career as an insurance adjuster.