The cost of insurance for a business varies widely, typically ranging from $300 to $1,500 annually for general liability coverage for small businesses. Factors influencing the price include the type of industry, size of the business, location, & claims history. Additional coverages, such as property, workers’ compensation, or professional liability, can increase costs. On average, small businesses spend about $1,200 per year on insurance. It’s essential to obtain quotes from multiple providers to tailor coverage to specific needs & budget.

how much does insurance cost for a business. Curious about how much does insurance cost for a business? Discover factors affecting business insurance costs & get tips for finding the best coverage!

Understanding Business Insurance Costs

Business insurance costs vary depending on multiple factors. Once I started my own enterprise, understanding expenses related to insurance became crucial. Higher premiums often present challenges, yet they ensure adequate coverage for unforeseen events. Learning about these costs proved beneficial in securing a suitable policy tailored for my needs.

Factors Influencing Insurance Premiums

Several factors impact insurance premiums businesses face. Each component plays a vital role in determining final costs. Understanding these elements allows business owners to make informed decisions regarding necessary coverage.

Type of coverage needed significantly alters premium costs. For instance, property insurance, liability insurance, & workers’ compensation each possess distinct pricing structures. Variability across types ensures thorough assessment during a policy selection process.

Another essential factor involves location. Businesses situated in areas prone to natural disasters or high crime rates may encounter steeper insurance costs. Insurers calculate risks associated with particular regions, leading to changes in premium pricing influenced by geographical characteristics.

Type of Business Structure

Business structure further contributes greatly to insurance costs. Sole proprietorships often experience lower premiums compared to corporations. Corporations face increased liability risks, which often raise costs. Risks inherent within nonprofit organizations may also vary, therefore, affecting insurance pricing.

Startup companies might experience different rates compared to established enterprises. Insurers consider longevity, financial stability, performance history, & overall economical outlook when determining premiums. New organizations often lack this crucial data, presenting challenges when obtaining insurance.

Industry-Specific Risks

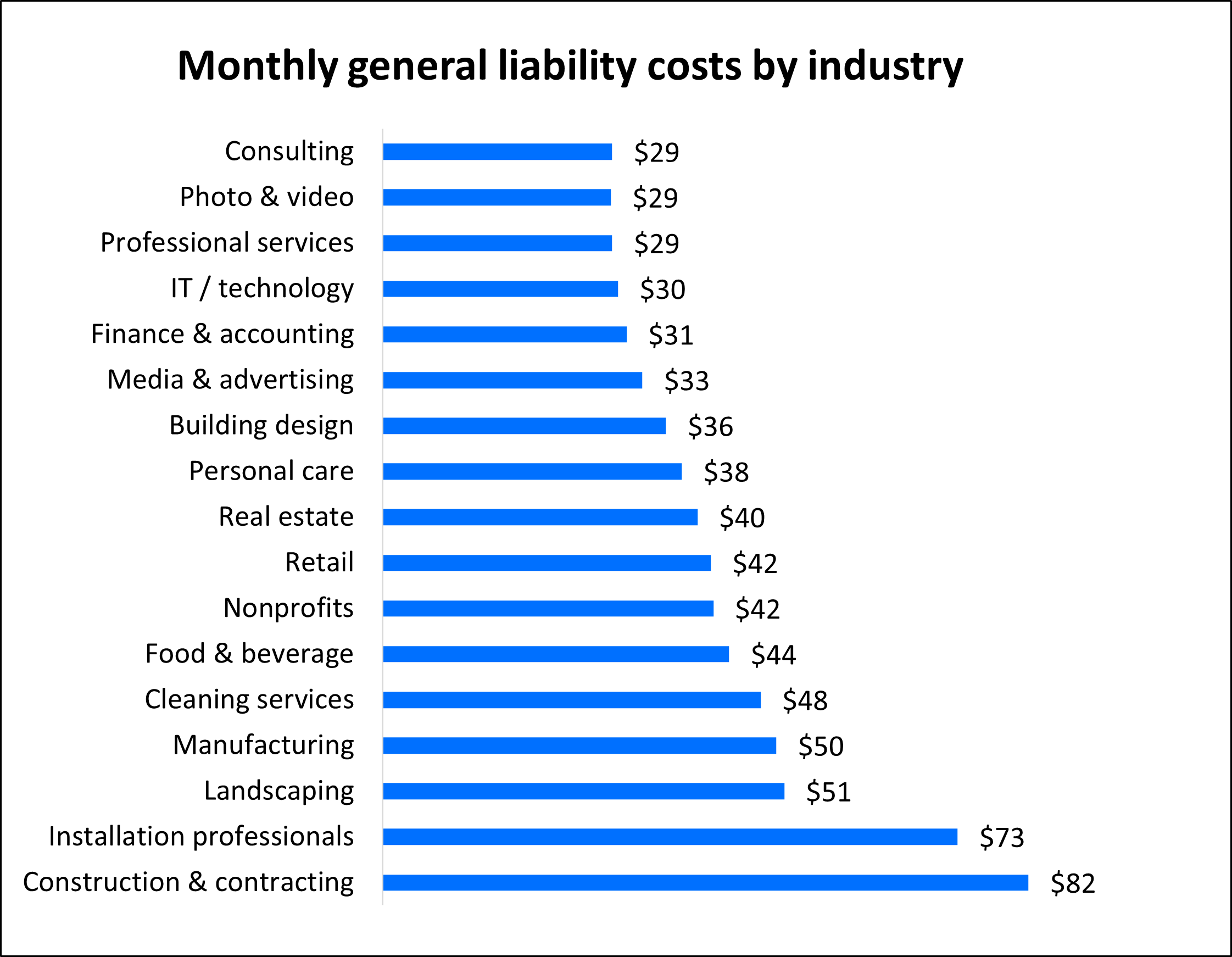

Certain industries carry more significant risks, directly influencing insurance expenses. For instance, construction companies contend with various hazards, from accidents to equipment damage. As a result, related insurance can become quite costly.

In a different context, sectors like technology may encounter lower risks, leading to more affordable insurance premiums. Evaluating industry specifics provides insight into potential insurance costs for any business venture planning.

Average Insurance Costs for Different Business Types

| Business Type | Average Annual Cost |

|---|---|

| Retail Store | $1,200 – $4,000 |

| Construction | $5,000 – $15,000 |

| Technology Firm | $1,500 – $3,500 |

Estimated Costs of Essential Policies

Understanding estimated costs associated with essential policies aids businesses in budget planning. Some common insurance types include general liability, property insurance, & workers’ compensation. Each serves unique purposes, offering various coverage levels.

A typical general liability insurance policy ranges between $400 & $3,000 annually based on factors discussed prior. This policy protects against claims of bodily injury & damage to third parties, making it essential for most businesses.

Property insurance rates often fluctuate based on location & property value. Businesses can anticipate spending anywhere from $500 to $2,000 annually for adequate coverage while protecting assets. This assurance transforms vital for economic stability, especially in case of loss.

Comprehensive Insurance Packages

For many enterprise owners, seeking comprehensive insurance packages provides added protection. Bundling multiple policies together frequently results in discounted premiums. These packages usually encompass property insurance, liability coverage, & sometimes even vehicle insurance.

Identifying reliable providers that offer comprehensive policies minimizes overall costs while ensuring proper coverage. Business owners benefit from thorough research, assessing several providers, & determining policy offerings thoroughly.

Common Insurance Types for Businesses

- General Liability Insurance

- Property Insurance

- Workers’ Compensation

- Professional Liability Insurance

- Commercial Auto Insurance

General Liability Insurance

This coverage type serves a fundamental purpose by protecting businesses against various claims. General liability insurance safeguards against operational risks, including property damage & healthcare expenditures stemming from injury on premises. And another thing, this policy protects business reputation through financial coverages.

Securing a general liability insurance policy costs dependently shapes your overall insurance expenses. Annual premiums usually vary from $400 to $3,000 according to factors influencing risk. Higher-risk businesses often incur steeper costs.

Overall, this coverage remains vital for any startup or existing business seeking protection against unforeseen events. Even small businesses can greatly benefit from understanding its necessity.

Workers’ Compensation Insurance

Workers’ compensation insurance constitutes a legal requirement in most states. Costs revolve around industry type, employee salaries, workplace safety measures taken, & absence or presence of claims history. Maintaining a safe work environment reduces premium costs significantly.

Annual expenses for workers’ compensation insurance typically range between $1,000 & $3,000. Companies can expect variations influenced by factors outlined. Careful evaluation of workplace dynamics reveals opportunities related to reducing these costs.

In addition, policies often require annual audits based upon payroll changes, reinforcing businesses’ financial commitment throughout their reporting cycles. Understanding these costs enables better planning moving forward.

Additional Coverage Options

Beyond essential & common policies, various additional coverage options exist tailored for specific needs. Many businesses enhance their coverage capabilities by including niche insurance options that align with operational goals. Coverage selections often incorporate different aspects, including technology, cyberattacks, or specialized equipment insurance.

Cyber liability insurance protects companies from damages related to breaches & data loss, which can be expensive & complex. These claims can arise from security failures resulting in significant financial losses. With premiums typically ranging from $1,000 to $7,000 annually, selecting this coverage might serve businesses well as they expand their online presence.

Another specialized policy includes equipment breakdown coverage. Coverage associated with damaging equipment may shield businesses from severe cash flow interruptions. Annual costs often amount to around $500 to $2,000, providing assurance that equipment failures won’t cripple operations.

Evaluating Costs with Risk Management Strategies

Implementing risk management strategies allows business owners to minimize overall insurance costs. By identifying & mitigating risks, companies can demonstrate reduced potential liabilities to insurance providers. This proactive approach often leads to lower premiums & financial incentives.

Regular training programs for employees dedicated to safety lowers injury occurrence & contributes positively toward workplace environment. Demonstrating commitment toward employee welfare often entices insurers, resulting in decreased expenses.

On top of that, annual audits facilitate thorough evaluations of current policy effectiveness & coverage adequacy for evolving needs. Regular reviews ensure businesses adapt policies, managing expenses accordingly based on changing operations.

The Importance of Comparing Quotes

Shop around for insurance quotes to discover potential savings. Not every policy remains the same; thus comparing multiple providers reveals differences that can lead to substantial financial benefits. Market variations encourage thorough assessments; this practice provides insight into potential gaps or overlaps within coverage spending.

Many websites facilitate comparing multiple insurance quotes quickly, streamlining processes for business owners. Utilize these resources effectively when seeking suitable plans, ensuring proper coverage that meets specific needs without breaking financial constraints.

Negotiation Possibilities

Navigating through insurance marketplaces provides opportunities for negotiation regarding pricing & coverage. Many insurers remain flexible, allowing potential clients to discuss specific needs. Businesses that express their requirements transparently often receive better packages fitted perfectly to their budget constraints.

Highlighting history, performance metrics, & business growth plans help negotiate stronger deals with providers. Insurers exhibit heightened interest in well-managed entities ensuring lower risks warranting lower premiums.

Insurance Costs & Tax Considerations

Insurance premiums remain tax-deductible expenses for many businesses, providing additional incentive for those uncertain about these costs. Deductions often apply under operating expenses, providing significant financial relief for entrepreneurs & established companies.

Understanding tax implications surrounding insurance expenses ensures informed financial decisions. Business owners can leverage deductions strategically, allowing them more flexibility in budgeting & resource allocation across other operational areas.

Consulting with financial advisors or accountants offers valuable perspectives concerning optimizing tax positions. Utilizing available deductions increases cash flow, benefiting overall efficiency & supporting growth endeavours.

Evaluating Overall Business Health

Whether assessing costs associated with insurance or other operational facets, overall health of a business reflects resilience against unforeseen events. Adequate coverage equips owners with necessary support, safeguarding from potential financial disaster arising from various risks.

Keeping tabs on business performance & aligned insurance policies offers a roadmap for achieving long-term success. Evaluating outcomes regularly enables adjustment possibilities, ensuring ongoing growth potential even during trying circumstances.

Future Considerations

Business insurance remains a dynamic aspect of management that requires constant updating. As businesses change, their needs prompt further evaluations concerning related costs & coverage. Initiating reviews periodically serves as an integral part of ongoing success.

And another thing, tracking trends across industry shifts allows businesses to assess whether current policies align effectively with updated standards or practices. Remaining vigilant provides necessary safeguards against setbacks that could affect operational performance.

Specialized Insurance Types & Their Costs

- Cyber Liability Insurance

- Business Interruption Insurance

- Surety Bonds

- Equipment Breakdown Coverage

- Pollution Liability Insurance

Resources for Business Owners

Numerous resources assist entrepreneurs in navigating through insurance landscapes, aiding decision-making processes. Industry associations & professional organizations often provide valuable insights regarding industry norms & expectations pertaining to insurance costs.

Online tools simplify comparisons among various offerings, presenting clear data regarding premiums, coverage limits, & exclusions. Websites such as these frequently contain user ratings & testimonials, allowing access to firsthand experiences of others.

Investment in education further substantiates validity surrounding informed decisions business owners undertake regarding insurance. Workshops & seminars locally or online cultivate knowledge-sharing environments, enhancing understanding while connecting with experts within fields.

Regular Market Assessments

Staying up-to-date regarding market shifts aids businesses in adapting cost structures efficiently. Conducting regular assessments provides critical information concerning changes that might prompt businesses towards better strategies, leading towards improved overall performance.

Regular checks inform businesses of any better value options emerging within industries, prompting shifts when necessary. Communicating with brokers or agents consistently provides ongoing opportunities for improved coverage types & knowledge surrounding available discounts.

| Insurance Policy | Estimated Annual Cost |

|---|---|

| General Liability | $400 – $3,000 |

| Property Insurance | $500 – $2,000 |

| Workers’ Compensation | $1,000 – $3,000 |

Cultivating a proactive approach when evaluating costs ensures businesses remain prepared for unforeseen obstacles.

Curious about how much does insurance cost for a business? Discover factors affecting business insurance costs & get tips for finding the best coverage!

Conclusion

In summary, understanding how much insurance cost for a business can be tricky, as it depends on various factors like the type of industry, location, & coverage needed. On average, small businesses might pay anywhere from a few hundred to several thousand dollars annually. It’s essential to compare quotes & discuss options with different providers to find the best fit for your needs. Remember, investing in the right insurance ensures your business is protected from unexpected challenges, allowing you to focus on growth & success. Don’t skip this crucial step for your business!