The cheapest place to get insurance for young drivers often varies by location & individual circumstances, but online comparison sites like Geico, Progressive, & State Farm typically offer competitive rates. And another thing, local credit unions & specialty insurers may provide discounts for young drivers, especially for those with good grades or completing safe driving courses. Bundling insurance policies, maintaining a clean driving record, & opting for a higher deductible can further lower premiums. Always compare quotes & explore available discounts to find the best deal tailored to your needs.

cheapest place to get insurance for young drivers. Looking for the cheapest place to get insurance for young drivers? Discover tips & options to save money on your coverage today!

Understanding Insurance for Young Drivers

Young drivers often face higher premiums compared to older, more experienced motorists. Multiple factors contribute to increased costs, including driving history, age, type of vehicle, & location. Shopping around for coverage helps individuals find options that suit their budgets. Factors like credit history, annual mileage, & coverage levels also affect rates. Each provider uses different criteria when calculating premiums, so researching various companies can lead to significant savings.

Shopping Around for Affordable Insurance

Finding a suitable insurance provider can often feel overwhelming, especially for those just starting out. To streamline this process, one effective strategy involves requesting quotes from various companies. Comparisons based on costs & coverage allow young drivers to identify which options are most affordable. And another thing, many platforms enable users to input personal data once, & receive multiple quotes back. This feature saves time while providing valuable insights into pricing structures.

Beyond quotes, evaluating policy features remains crucial. In some cases, higher premiums may offer better coverage, including added features. Young drivers must weigh cost against coverage comprehensively. Looking into special discounts offered by various providers proves beneficial as well. Some companies extend discounts for good students, safe driving records, or bundling options with other types of insurance.

Top Companies Offering Coverage

Young drivers often wonder which insurance companies provide best rates for their demographic. A few standout providers cater specifically to this audience. Here’s a comprehensive overview of these companies & their potential offerings.

Leading Companies for Young Drivers

- GEICO

- State Farm

- Progressive

- Allstate

- Esurance

Each company boasts distinct advantages. For example, GEICO often provides competitive rates along with a user-friendly app, making managing policies more convenient. State Farm’s multi-policy discount can yield significant savings if a young driver also needs renters or homeowners insurance.

Progressive, known for its Name Your Price® tool, presents options for those seeking a balance between premium costs & coverage levels. Allstate offers comprehensive resources geared towards new drivers, while Esurance emphasizes an online platform for quick quote comparisons.

Factors Influencing Insurance Costs

Various elements factor into determining insurance rates, particularly for young drivers. Understanding these components empowers individuals to make informed decisions regarding their policies. Age remains a principal aspect influencing costs, with younger, less experienced drivers typically facing higher premiums.

Vehicle type also plays a critical role in insurance calculations. High-performance or luxury cars often attract steeper premiums due to repair costs & theft rates. In a different context, opting for more economical, used cars may result in lower insurance costs.

Another significant factor includes location. Urban areas usually come with higher premiums relative to rural settings, as cities tend to have increased traffic congestion, higher accident rates, & greater theft occurrences. When selecting a vehicle & policy, understanding these considerations can lead to more affordable coverage options.

How Discounts Work

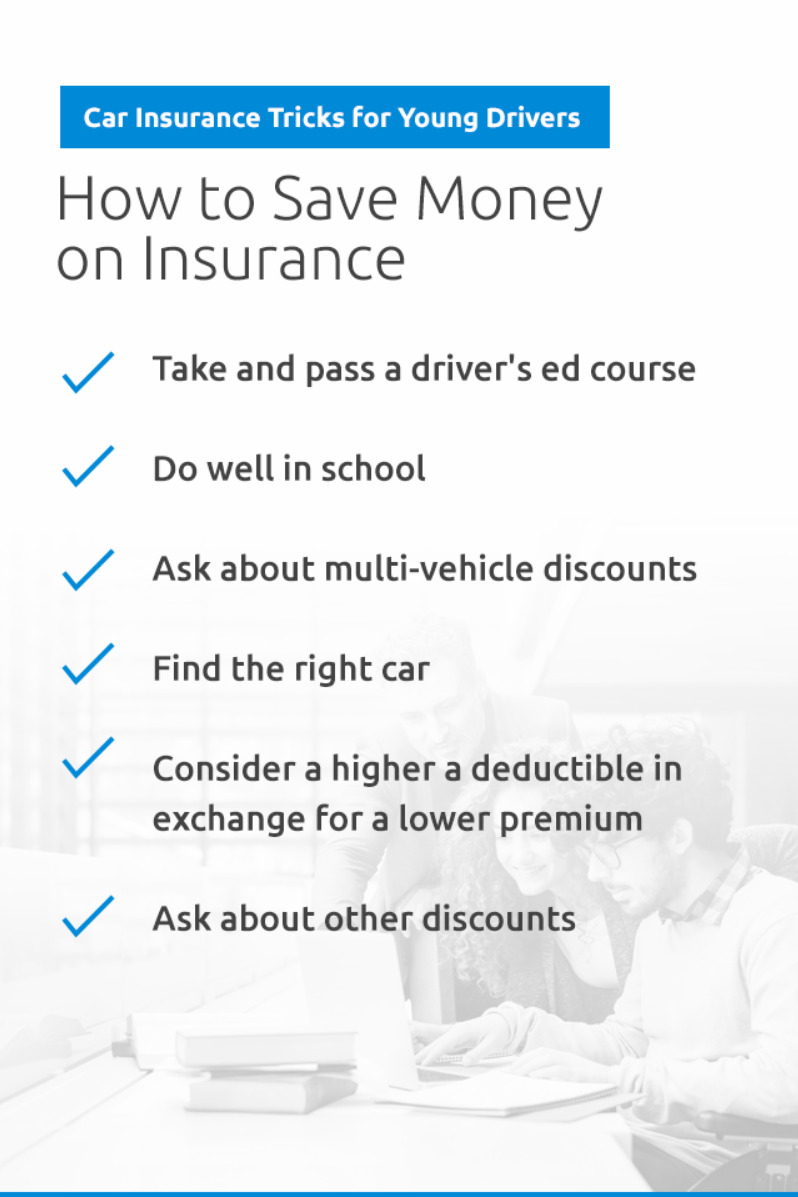

Many insurance companies offer discounts tailored for young drivers, which can considerably reduce premiums. Good student discounts feature prominently among these, rewarding those maintaining a GPA above a certain threshold. This incentive not only encourages academic excellence but serves as a financial benefit.

Safe driving discounts also exist, often requiring individuals to maintain an accident-free driving record for an extended period. Some providers utilize telematics as well, providing further discounted rates by monitoring driving behavior through apps or devices. Safe driving habits lead to lower insurance costs an exciting prospect for young drivers.

Discount Programs for Additional Savings

- Good Student Discount

- Safe Driving Discount

- Policy Bundling Discount

- Low Mileage Discount

- Telematics Discount

In addition, many insurance providers offer discounts for bundling multiple policies, such as home or renters insurance. By choosing one company for various insurance needs, individuals may secure better rates overall. Low mileage discounts can apply for those driving fewer miles than average annually as well.

Utilizing Online Tools & Resources

With advancements in technology, young drivers have access to online tools that simplify the process of finding affordable insurance. Comparison websites enable users to enter their information once & receive numerous quotes from multiple companies. This allows individuals to easily compare prices & coverage without manually contacting each provider individually.

On top of that, many insurance companies offer websites & mobile apps that streamline policy management. Young drivers can check coverage details, make payments, or file claims through their personal devices. Embracing these technological solutions not only enhances convenience but ultimately saves time & money throughout the insurance procurement process.

The Importance of Reviews & Recommendations

Investigating customer reviews & recommendations for insurance providers greatly influences decision-making. Online platforms allow existing customers to share experiences, both positive & negative. Young drivers benefit from reading these reviews, as they provide insight into how actual policyholders perceive company service, worthiness, & claims processes.

Seeking recommendations from trusted friends or family members also proves beneficial. Personal insights help highlight companies known for excellent service & competitive rates. When selecting an insurance provider, considering community feedback allows individuals to make more confident, informed choices.

Average Costs for Different Coverage Levels

Understanding average costs associated with varying coverage levels helps young drivers align their budgets accordingly. Basic liability coverage represents one option, typically resulting in lower premiums. Be that as it may, this coverage might not adequately protect policyholders in case of accidents involving substantial damages.

Comprehensive coverage options, while usually more expensive, offer broader protection suitable for those seeking peace of mind. When considering various types of coverage, understanding average costs allows young drivers to make educated decisions based on their unique circumstances & needs.

Cost Breakdown by Coverage Level

| Coverage Type | Average Cost |

|---|---|

| Liability Only | $100/month |

| Full Coverage | $200/month |

| Comprehensive | $250/month |

This table highlights average costs for different coverage types, enabling young drivers to evaluate their options. While basic plans offer lower premiums, full or comprehensive coverage options provide greater protection in most scenarios. Ultimately, selecting appropriate coverage depends on individual preferences & financial situations.

Shopping Tips for Young Drivers

When searching for affordable coverage, young drivers should keep several practical shopping tips in mind. First, take advantage of online comparison tools to evaluate multiple options. Gathering numerous quotes enables straightforward comparisons, leading to making effective choices according to budgetary constraints.

Each insurance provider offers unique perks, & evaluating these while shopping can result in long-term benefits. And another thing, doing thorough research before finalizing any policy remains essential; reviewing the details of terms & potential changes can prevent unpleasant surprises later.

Lastly, maintaining a clean driving record significantly impacts premium rates. Committing to safe driving can lead to qualitative benefits over time. Not only does this approach support lower premiums, but it enhances overall driving skills valuable for any young motorist.

Insurance Carriers with Competitive Rates

- Farmers Insurance

- Liberty Mutual

- Nationwide

- American Family Insurance

- MetLife

These companies often present competitive rates tailored specifically for young drivers. Farmers Insurance, for example, provides personalized insurance advice, while Liberty Mutual offers unique savings opportunities. Nationwide typically prides itself on customizable policies, enabling individuals to select coverage tailored to specific needs.

American Family Insurance focuses heavily on customer experience, with support options ranging from mobile apps to personalized agents. MetLife embraces flexible payment arrangements, making it easier for young drivers to manage premiums within their budgets.

Personal Experience with Affordable Insurance

During my search for an affordable option, I encountered multiple companies that offered attractive rates. After comparing various quotes, I discovered one provider, which stood out with its competitive prices & customer-friendly approach. I ultimately selected a plan that provided adequate coverage at a reasonable cost, significantly easing my financial burden.

Resources for Young Drivers

Various resources exist to help young drivers navigate insurance options more effectively. Websites like NerdWallet & Insurance.com offer reviews & comparison tools tailored to this audience. These platforms play a vital role in empowering individuals in search of coverage, providing insights into average rates, discounts, & advice specific to young motorists.

And another thing, engaging with independent agents allows young drivers to receive personalized service & recommendations best suited for their needs. These agents can evaluate options across multiple carriers, purchasing policies through them may uncover hidden discounts or promotions.

Understanding Policy Terms & Conditions

Reading & comprehending policy terms & conditions remains crucial for young drivers seeking affordable coverage. Each policy outlines specific details regarding limitations, exclusions, & responsibilities associated with coverage. By thoroughly reviewing these components, individuals can avoid potential misunderstandings or surprises when filing a claim.

Understanding the significance of deductibles also cannot be overstated. A higher deductible often leads to lower premiums, but individuals must be prepared to cover that expense in case of an accident. Balancing deductible amounts with overall coverage needs helps young drivers make confident, informed choices when selecting policies.

Final Thoughts on Affordable Insurance Options

For young drivers, locating an affordable insurance provider often feels daunting, yet ample resources & tactics are available to help ease this burden. Recognizing factors influencing premiums, utilizing discounts, & leveraging online tools can ultimately streamline this process. By following the outlined shopping tips, engaging with trustworthy insurance carriers, & fully understanding coverage requirements, individuals can discover options suited for their financial situations.

Key Statistics on Young Driver Insurance Costs

| Demographic | Average Insurance Cost |

|---|---|

| 16-19 Years Old | $400/month |

| 20-24 Years Old | $250/month |

| 25+ Years Old | $180/month |

This table illustrates average insurance costs segmented by age groups. Younger drivers typically face the highest rates, gradually decreasing as they age & accumulate driving experience. Recognizing this trend can assist individuals during their search for the most affordable insurance options.

Choosing the right insurance for young drivers does not have to feel overwhelming. With proper resources, making informed decisions hinders financial strain.

Finding Community Support & Resources

Many communities offer resources geared toward young drivers seeking information on insurance. Local organizations, schools, or driving instruction centers often provide valuable insights & workshops that focus on insurance education. Engaging with these resources enables individuals to build a foundation of knowledge that proves crucial when navigating the insurance landscape.

On top of that, joining online forums & discussion groups composed of young drivers can facilitate shared experiences & recommendations. Community outreach fosters an environment filled with encouragement & support, offering insights that enhance decision-making processes regarding coverage.

Ultimately, harnessing community support can empower young drivers to find affordable options while building awareness around safe driving practices.

Looking for the cheapest place to get insurance for young drivers? Discover tips & options to save money on your coverage today!

Conclusion

In summary, finding the cheapest place to get insurance for young drivers doesn’t have to be a hassle. By comparing quotes online, using discounts, & considering usage-based policies, you can save a lot. Don’t forget to check out local providers, as they sometimes offer better rates. Remember, the key is to stay informed & shop around. Each driver’s needs are different, so what works for one may not work for another. Keep these tips in mind to secure the best deal possible. Happy driving & insurance hunting!